become a supporter

support Ribble Rivers Trust

There’s simply no better way to help us. When you support Ribble Rivers Trust you’re taking action for your local rivers, helping to protect them now, and for generations to come.

Donating is easy. Simply click on the donate button below and enter your details to support Ribble Rivers Trust today. You can choose to make a one-off donation, or you can set up a regular monthly donation of just £3. Every donation, no matter how small, makes a difference.

Our mission is simple- to ensure that our rivers are protected for generations to come, but we can’t do it without the people that support Ribble Rivers Trust. In fact, we rely on the generosity of people like you to fund our crucial work. So, we’re asking you to consider donating just £3 a month to support our efforts.

How your support will help

Your donation will go directly towards on-the-ground action that will make a real difference in the health and vitality of our rivers. Ribble Rivers Trust take on the ground action to remove river blocking weirs, engineer new wetlands, and create new woodlands, all with the goal of making our waterways healthier and more resilient.

And we do more than just environmental restoration. Our team work closely with urban and rural communities. Together we help people make positive changes to their lifestyles, businesses, and farming practices that will benefit both people and the environment. Specialist staff also teach primary school children about the importance of rivers in the natural world, inspiring the next generation of conservationists.

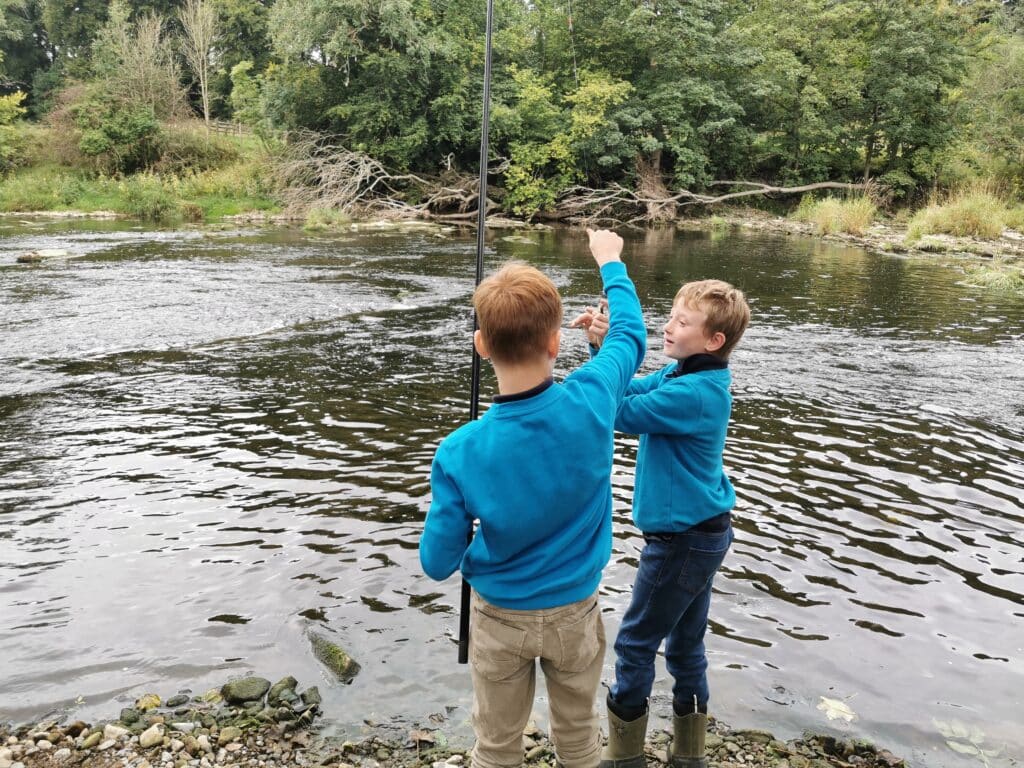

Our goal is a world where our rivers are clean and healthy. Where we can play and explore in nature and where wildlife thrives and rivers teem with life. That’s the world that Ribble Rivers Trust is working to create. When you become a supporter, your help means our charity can make that vision a reality.

Take me to:

About gift aid

Gift Aid your support if you want the Ribble Catchment Conservation Trust Ltd (Registered Charity No 1070672) to treat all donations you make as a Gift Aid Donation. This starts from the date you begin supporting us until you notify the trust otherwise or cancel your support.

Explanatory notes;

For every £1 donated through Gift Aid we can recover from HMRC a further 25p at no cost to you. Gift Aid is reclaimed by our charity from the tax you pay for the current tax year.

You must be a UK taxpayer to make a valid Gift. If you pay less Income Tax and/or Capital Gains Tax than the amount of Gift Aid claimed on all your donations in the tax year, it is your responsibility to pay any difference.

You can claim higher rate tax relief on Gift Aid Donations.

A Declaration can be cancelled at any time by notifying us. It must cease if you no longer pay sufficient tax on your income and/or capital gains.